The quality of life in Australia is among the best in the world. Its economy has been expanding for over 21 yrs and it is considered to be the most stable nation as far as the Economy is concerned.

It is one of the few Western nations that avoided a slump. While the country’s debt as a proportion of GDP is 10%, the unemployment rate is only 5.4%. What is the cause of this achievement? Certainty is one thing.

Australia has recently been going through a mining surge. Basic materials are exported by the nation. China and Malaysia are two growing Asian nations that are the main drivers of demand. China has been the nation’s top business partner since 2007.

The nation benefits greatly from rising commodity values as well as from foreign investment in its mining industry.

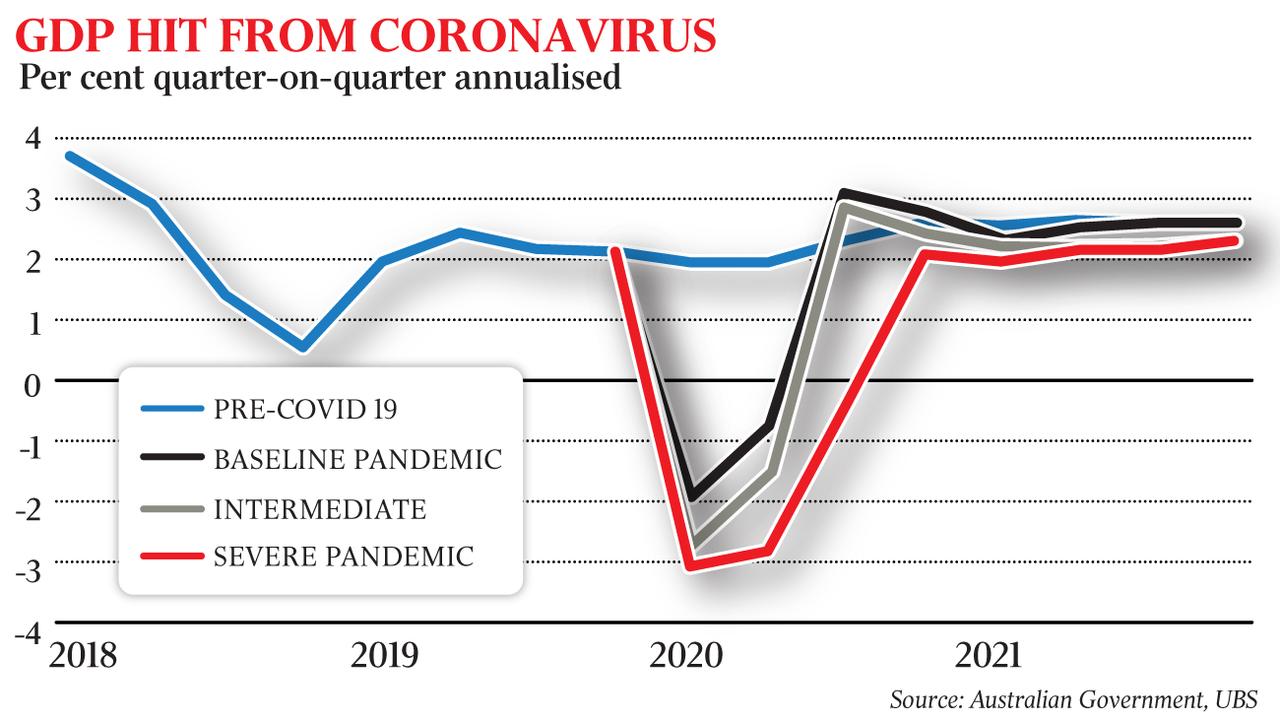

However, it is no secret that the world economy is constantly shifting, and the most recent COVID-19 impacts seem to only accentuate this reality.

In particular, lockdowns and regulations related to the nation’s reaction to the global pandemic have severely hampered the Australian economy.

Nevertheless, it is anticipated that the economy will adjust to these changes through worker development and the adoption of a greener, more sustainable strategy.

Here, we briefly discuss the present economic situation in Australia, how COVID-19 changed everything, and the prospects for the Australian economy going forward.

Australia’s Current Economic Situation

It’s crucial to first comprehend what we truly mean by the term “economy” in order to comprehend the current state of the Australian economy.

There are a few fundamental concepts to understand even though we won’t be able to cover everything about what a market is right now.

An economy is a network of relationships between the factors of creation. There are also regional economies, national economies, and global economies, so output and consumption take place on a variety of scales.

Simply put, an economy consists of buyers and sellers as well as the players in the government who control and tax these exchanges.

Gross domestic product, also known as GDP, is a common metric for assessing an economy. The Gross Domestic Product (GDP) of Australia is a gauge of how much economic development there is or isn’t.

Therefore, it is said that Australia’s GDP growth rate is rising when consumers can make big purchases and sellers can satisfy those demands. Sellers, however, are then unable to sell when consumers are unable to spend. It is said that Australia’s economy is collapsing in those circumstances.

Of course, this is an oversimplified explanation of what an economy truly is, but in general, this buyer-seller interaction comes up when most people discuss the Australian economy.

This concept of a healthy economy is also related to the Australian inflation rate, supply and demand, production prices, resource availability, and other factors. Again, we won’t get into the specifics of the business at this time.

However, it’s fair to say that not all areas of the Australian economy are doing so well.

Australian Economy’s Response to COVID-19

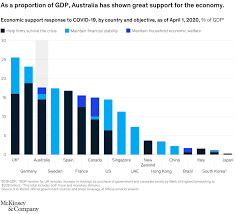

Image Credit: https://www.mckinsey.com/featured-insights/asia-pacific/the-curse-of-the-lucky-country-in-search-of-economic-antidotes-to-covid-19

As a reaction to COVID-19, Australia implemented lockdowns, contact tracing, mask-wearing, travel bans, and social seclusion. But depending on the sector you worked in and where in Australia you lived, these changes could have a significant impact on the economy.

Nevertheless, it cannot be denied that COVID-19 has a significant influence on both the Australian workforce and the country’s GDP. Among COVID-19’s effects are some of the following:

- Looking out across the 2020s

- Education Disruption

- Healthcare Disruption

- Supply Chain Disruption

- Inflation Rate in Australia

This undoubtedly condensed list of some COVID-19 effects on Australia’s industry is undoubtedly lacking. Now, however, let’s examine each of these elements and how they impact Australia’s economic growth or the absence thereof.

Looking out across the 2020s

And so, here we are in the middle of 2022: An economy that roared back to life following the COVID recession, but had its typical trade and migration links to the world disrupted, now battles with labour and supply chain shortages as the spectre of a global inflationary crisis slowly approaches.

If the only goal of our strategy is to address the economic problems of 2022. However, the shocks from the Covidian period will have a much greater transformative impact on the Australian economy than just these current problems.

Moving ahead, it is evident that Australia will need to reconsider many of its fundamental economic presumptions in order to succeed post-COVID. Over the next ten years, five new structural obstacles are likely to make a difference in whether we succeed or fail.

Useful Article:

Australian Startup Ecosystem 2025: Sydney vs. Melbourne and the Rise of Deep Tech Investment

Why Australian Small Businesses Are Failing In Early Stages

Time To Prepare For Aussie Small Businesses

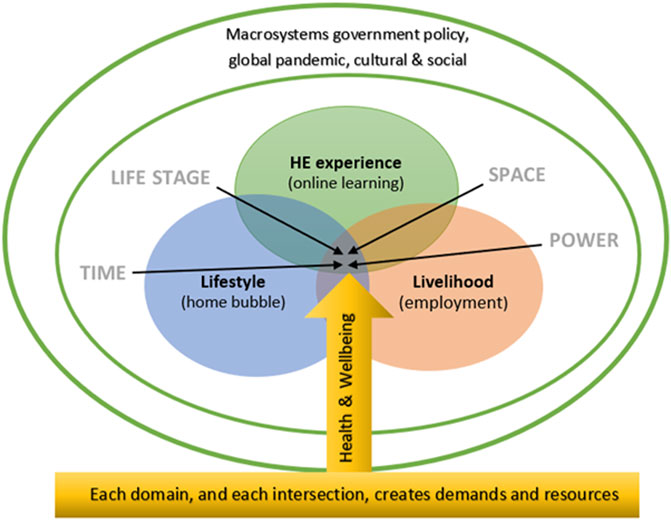

Disruption in the Educational System

Next, COVID-19 limitations have severely disrupted education at all levels. Over 87% of the pupil population worldwide, including every state in Australia, will no longer receive a K–12 education by March 2020, according to UNESCO.

Australian students who were upskilling or pursuing higher education were also impacted, in addition to the fact that many of them were pulled out of school to learn for the first time in a virtual setting.

New educational approaches will be necessary to support the Australian economic system’s development, especially for sectors that demand highly skilled workers or workers who learn best in a face-to-face environment.

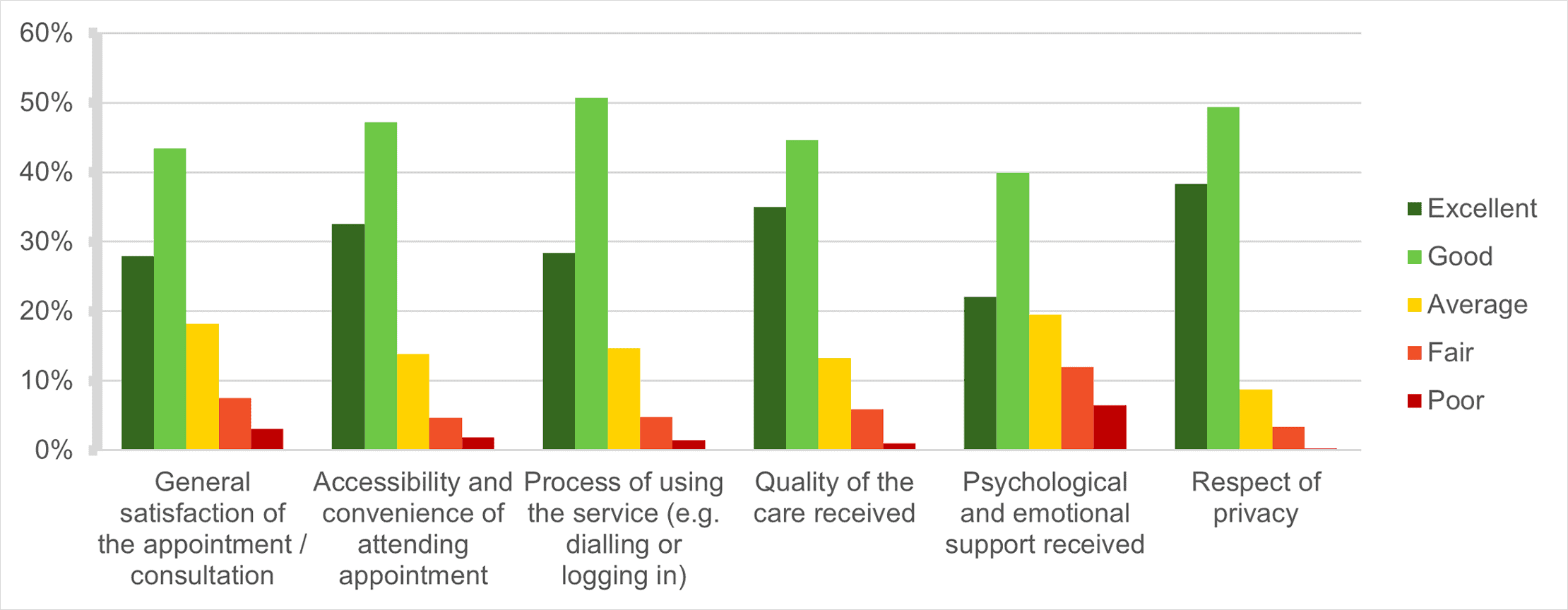

Medical disruption

Once more, Australia’s economy is in jeopardy without a healthy labour population. Therefore, other medical treatments may be delayed as hospitals concentrate all of their efforts on avoiding COVID-19 outbreaks in the future.

According to the findings of a WHO survey, even a year into the pandemic, about 90% of countries are still reporting one or more critical healthcare disruptions caused by COVID-19.

As a result, even though these protocols are in place to protect Australians from COVID-19, the disruption in the provision of appropriate healthcare is another factor contributing to the destabilisation of Australia’s GDP.

Supply – Chain Breakdown

Although it was only barely touched upon earlier, the relationship between supply and demand is crucial to comprehend the state of an economy.

You’re in problems whether there isn’t enough supply to meet demand from customers or there is too much supply compared to demand. The general economy operates under the same tenet.

Supply chains have been severely harmed by COVID-19 and its associated travel bans, border restrictions, and workforce disruptions, as anticipated.

Medium and small Australian Businesses are more likely to fail when they can’t procure enough products to sell to consumers. And the general economy suffers because there are fewer businesses to satisfy consumer demand.

Apart from that the bitter economic relations between Australia and China have also contributed to disruption in the supply chain.

Inflation Rates

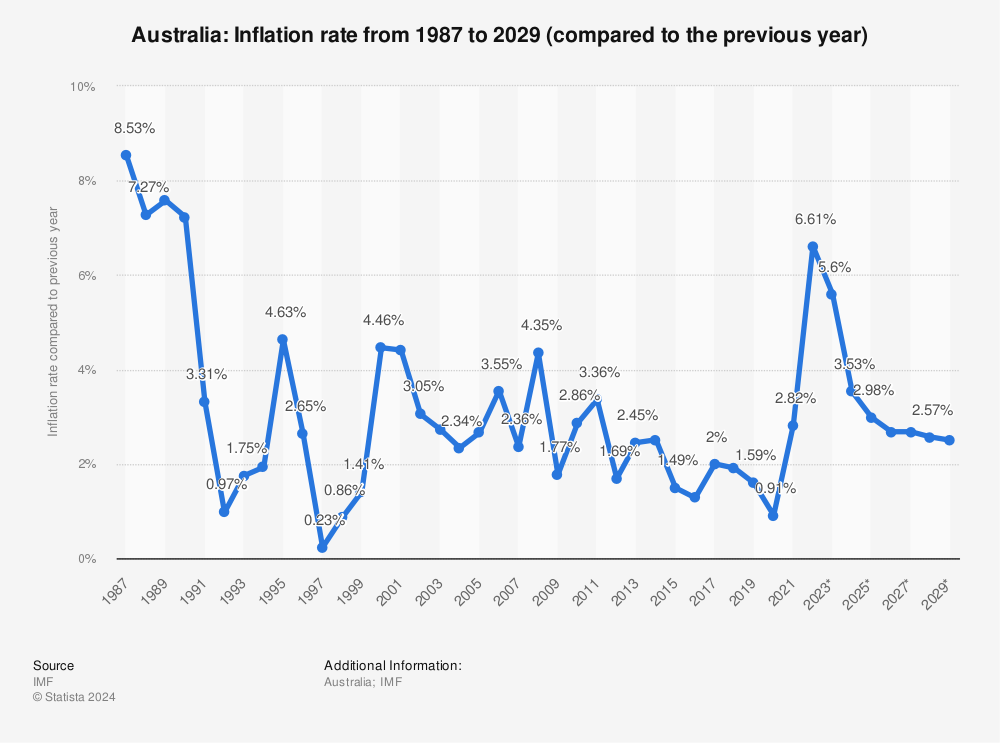

Another worldwide issue that is starting to affect Australia is higher inflation.

After two years of gradually increasing supply chain pressures, the Russian invasion of Ukraine earlier this year caused a sharp increase in energy and food costs. Australia’s inflation soared as a consequence, reaching a record-breaking 6.1% in the June quarter.

In just four months, the central bank was forced to increase rates from 0.1% to 1.85%, and it will be forced to continue fighting until inflation returns to the target range of 2-3%.

Despite the fact that these rate increases are essential, they are burdening the economy’s demand side. We already face significant labour and supply chain constraints on the supply side. And as interest rates rise, customer confidence and spending are declining, hurting the demand side.

Undoubtedly, the Australian inflation rate must be viewed in a larger context. Australian inflation is only two-thirds of that of our rivals when compared to the OECD. This is because Australia produces a lot of food and energy, the two commodities that account for the majority of inflation. As a result, our agricultural and energy industries are protecting us from the full force of the tide.

Australian small businesses have been severely impacted by higher inflation rates, and while taming inflation will be challenging, it won’t be as challenging as in most other developed nations.

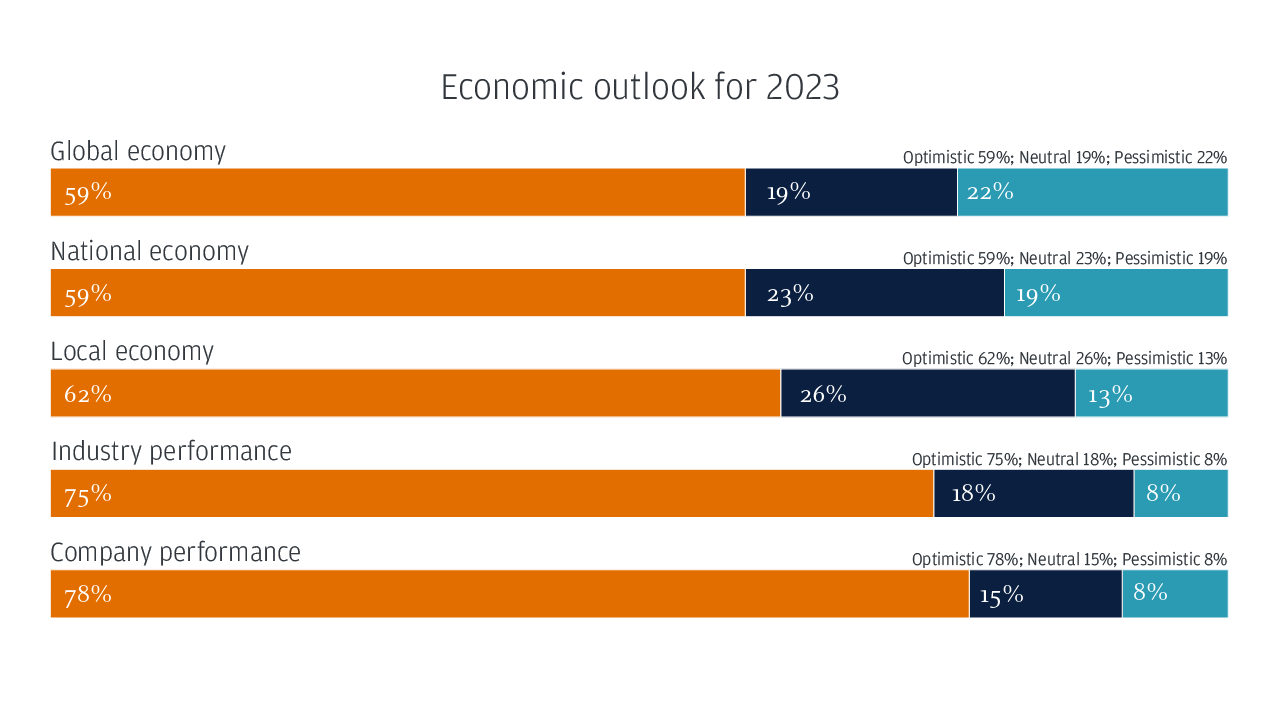

Australian Economy Forecast

Numerous forecasts have been made regarding the direction of the Australian economy in the wake of COVID-19.

And while it might take some time for the Australian economy to recover from the undeniably significant setbacks it has suffered since March 2020, the changes that could happen going forward aren’t necessarily all negative.

But in order for Australia’s economy to grow over the coming years, a few things will probably start to alter there:

- Development of the workforce will alter.

- Hybrid employment will become commonplace.

- Australia’s industry will change to a green one.

Employment Growth

First and foremost, there will surely need to be changes made in how we train our workforce in the future. Australians are now required to learn and adjust more quickly than ever because COVID-19 will forever change the nature of the workplace (in addition to the rapid advancement of technology).

Early 2021 research from LinkedIn revealed that during COVID-19, 130% more employees spent more time learning and that there were 159% more Leaders who supported learning and development.

Focus-wise, workforce development is probably going to pay more attention to technology, upskilling on a regular basis, integrating data and AI, teaching, mentoring, and management, as well as putting more emphasis on business goals.

To put it another way, any business will require the Australian workforce to be in a constant state of development.

In simple words, we need more Australian Start-Ups.

Hybrid Jobs

The fact that hybrid jobs exist in the Australian economy is another shift brought about by COVID-19. A hybrid job basically combines two or more formerly distinct roles into a single position.

For instance, people who previously only worked as programmers are now sometimes required to also be technical writers and managers.

Whether this strategy will have long-term effects on the employees themselves is still up for debate. But in fact, technology is advancing so quickly that workers worry they will be left behind if they don’t equip themselves with a diverse set of skills.

Making the Switch to a Green Economy

Last but not least, the shift to a green economy is most likely the only forecast for Australia’s economy that has little bearing on COVID-19. The sustainability of Australia’s GDP and climate change are major issues that economics undoubtedly take into account.

You’d be hard-pressed to find an economy that can operate without ecological resources if an economy is solely driven by supply and demand.

Your nation probably buys natural resources even if it doesn’t trade them. In other words, nobody is immune from considering how their economies will be impacted by climate change.

For employees, what does a green economy mean? Time will only reveal.

What’s Next For the Australian Economy?

It is standard practice to conclude economics presentations with a forecast or statement of the future. But today, I’m not going to do that. Our ability to provide reliable quantitative future predictions in a global economy that is suffering from shocks is simply not what it once was.

But we do know that these disruptions won’t stop. Supply networks won’t return to normal overnight, inflation won’t vanish overnight, and volatility will rule the day.

This year has already brought about one significant global black swan, namely Russia’s invasion of Ukraine. The troubling events in Taiwan over the weekend should dispel any illusions we may have had to the contrary.

Australia is not in a position to control these political and economic disruptions. However, we can organise our homes to ensure that we are in the best possible situation to withstand both recent and impending shocks.

The COVID reset is an opportunity for us to rethink some important issues with our economy. What function has migration? Which types of goods? How can technology and money be attracted? What will a productivity plan in 2020 look like? What does industrial supply chain security entail?

The solutions are still being worked out. However, it is these inquiries that offer the framework for modifying the Australian economy to a world in which shocks are prevalent. Our current job is to search for solutions that will guarantee Australia’s upcoming generation enjoys the same level of prosperity and financial security as the present.