The post Australian Business Innovation and Investment Visa Under Subclass 188 appeared first on TheAussieway.

]]>

Subclass 188 Visa as a Pathway to Subclass 888

In recent time Australian has been promoting entrepreneurial culture to encourage foreign direct investment in the country. Hence, this business visa under subclass 188 is perfect for immigration so that such foreign business persons may invest in this country for a maximum of four years. However, there are sudden criteria that you have to fulfill to qualify to this visa including-

- Having a successful business career

- A substantial amount of assets

- Capacity to invest in Australia

Before you go all giddy over the subclass 188 visa, it is crucial to note that every visa, including this one, has its limitations This particular visa is merely a temporary or provisional visa that grants entry of foreign investors to the Australian business market. With this visa, you can only conduct business in Australia for 4 years. But don’t let this disappoint you! This visa ensures the holder can obtain a permanent residency in Australia as subclass 188 is a route to Subclass 888, and the holder, as well as members of the family unit, will be able to work, conduct studies, and reside in Australia permanently.

The subclass 188 visa holders can apply for permanent residency after successfully operating their businesses or investments in Australia for a specified period, through the subclass 888 visa. This subclass 88 visa is also known as the Business Innovation and Investment visa. This visa is designed to attract successful investors and entrepreneurs to stay in Australia and contribute to the economy of the nation. If you are ready to take the first step towards permanent residency in Australia, keep reading to learn more about the subclass 188 visa and the subclass 888 visa.

Eligibility Requirements for Subclass 888

To qualify for the subclass 888 visa you need to meet the following requirements:

- You must hold a provisional Business Innovation and Investment visa (subclass 188) or hold a Special Category visa (subclass 444) or a Business (Long stay) visa (subclass 457IE).

- You must meet the requirements of the provisional visa in the stream in which you first applied which may include meeting investment and turnover thresholds and maintaining the business for a stipulated period.

- You must pass the points test.

- You must ensure that your business complies with all the Australian rules and regulations.

Additional Requirements:

- You have to be nominated by the Australian state or territory.

- You need to have evidence of meeting the health and character requirements for a 188 visa.

- You and your family members must be free from any outstanding debts to the Australian government.

Benefits of Subclass 888

Once you get hold of the subclass 888 visa, you’ll be all set to permanently reside in Australia. Here are some benefits you can enjoy with this visa-

- You can live, work, and study in Australia for an indefinite time.

- You’ll be able to enroll in Australia’s program for health coverage

- After meeting some required criteria, you’ll be able to apply for Australian citizenship.

- You’ll be able to sponsor your other relatives for permanent residency in Australia.

- You’ll be able to leave and re-enter Australia from the date the visa is granted (after 5 years on your permanent residency visa, you need to apply for a resident return visa to extend your travel facility).

Importance of Seeking Professional Advice

Suppose you are a business owner planning on expanding internationally and applying for visa for business in Australia. In that case, the application itself sometimes can be the trickiest part of the process for you. A process that can set you back by a fairly long time if done wrong. Applying for a visa while complying with all rules and passing the points system is an extremely complicated process and no matter how prepared you might be, there is always a possibility that something can go wrong. This is why you need expert help from migration agents. Seeking help from professional migration agents and lawyers is beneficial because-

- These are professionals in visa issues and have dealt with the process for several years hence decreasing the possibility of a declined visa.

- They take on the responsibilities on your behalf making the visa process more convenient and hassle-free for you.

- They can expedite the process by ensuring that your documents are correctly compiled, filled, and submitted within the right time.

- They can provide customized advice and guidance tailored to your specific needs and circumstances.

- Immigration consultants can provide additional services beyond visa application assistance like travel assistance and accommodation.

- They can help alleviate the stress and anxiety associated with the visa application process by providing guidance and support throughout the process.

The post Australian Business Innovation and Investment Visa Under Subclass 188 appeared first on TheAussieway.

]]>The post 10 Australian Startups In 2023 That Can Change Aussie Lifestyle appeared first on TheAussieway.

]]>

From tropical beaches to aboriginals, cute koalas, rolling wines, and lush rainforests, there’s nowhere like Australia.

Besides, being a tourist hub, Australia is also where businesses thrive, especially startups.

Brands like Gleam and Canva are first-hand examples. Currently, the numbers look pretty impressive, with more than 1800 neo-age brands making an impact.

The reasons aren’t obscure enough to scan.

A. A rock-solid economy: Australia is the 13th among large economies that haven’t witnessed recession for over a couple of decades. Also, this nation has a pretty low unemployment rate and shows stable growth.

B. Strong and uncompromised VC funding: With more than 100 VC firms investing in Australia, coupled with incubators and accelerators, startups are blessed with early-stage boost-ups. Take 2022, for instance, when Australian startups raised no less than $5.1 Billion. Surprisingly, it’s a drop from 2021. Now, that’s growth right there.

C. Proactive support from the government: Perhaps one of the most compelling reasons why Australian startups stay profitable is the push from the government. Whether it’s small grants or the ambitious Startup Year Program launched in 2022 aimed at bringing more entrepreneurs to the mainstream market, there’s no dearth of motivation.

Here’s a look at 10 promising Australian startups in 2023 that can impact the Aussie lifestyle.

Dovetail

Dovetail is 2017 Australian marketing startup operating out of Sydney. It is a SaaS solution platform that works towards aggregating customer feedback and research under one roof.

In short, Dovetail makes it easy to monitor customer satisfaction and incorporate necessary changes every now and then.

Since they began, Dovetail has been through some high-profile funding, including a $63 Million Series A round led by Accel in 2022. No wonder, Dovetail’s business model has become popular in no time.

The company at a glance

Key People: Benjamin Humphrey, Bradley Ayers

Location: Sydney

Number of employees: 51-100

Area of focus: Customer Research

Similar organizations: POTLOC, Crowd Analyzer, and Tetra Insights

Athena

Another 2017-born Aussie startup, Athena, is headquartered in Sydney and is a rising star in the fintech space.

As a solution provider organization, they help individuals accelerate their home loan repayment and simplify the process of purchasing a home.

By connecting homeowners and prospective homeowners with ethical investors, Athena has been able to successfully address the most pressing demands. The company set a new record for the largest fundraising ever achieved by an Australian company in May 2021 (a whopping $90 million).

The company at a glance

Key People: Michael Starkey, Nathan Walsh, Rex V. Job

Location: Sydney

Number of employees: 101-250

Similar organizations: Lendi, Grapple, Shift

Eucalyptus

Eucalyptus came into existence in 2019.

Headquartered in Haymarket, they operate within the healthcare sector, offering brands a chance to widen their scope of aid to individuals for healthcare services across the country.

Over the years, the company has helped at least 250,000 patients receive improved healthcare support. Eucalyptus has also successfully secured funding through multiple rounds, including a notable $42 Million Series C round in January 2022.

The company at a glance

Key People: Alexey Mitko, Benny Kleist, Charlie Gearside, Tim Doyle

Location: Haymarket

Number of employees: 51-100

Area of focus: Healthcare

Similar organisations: Tendo, Syllable, Pera Labs

OCR Labs

OCR Labs had a humble beginning in 2014. Currently, its headquarters are in Sydney, where the company is emerging in the world of fully automated identity verification.

As a tech-driven company, OCR Labs has made it possible for individuals to access identity verification needs remotely no matter the geographical position. This, in turn, has dramatically reduced the vulnerability to fraudulent activities utilizing biometric data.

OCR Labs has also secured multiple rounds of funding, including a Series B in February 2022 ($30 Million raised).

The company at a glance:

Year Founded: 2014

HQ: Sydney, New South Wales, Australia

Size: 11-50

Key People: Daniel Aiello, Matthew Adams

Similar companies: Onfido, Jumio

Judo Bank

As a technology-driven lender, Judo is essentially a neobank specializing in financing solutions for small and medium-sized enterprises. Furthermore, it also offers a variety of personal term deposit products to individuals.

As of January 2020, Judo Bank has successfully extended loans worth $1B to Australian small businesses, while also accumulating $1B in digital retail term deposits.

The company at a glance

Year Founded: 2016

HQ: Melbourne

No. of employees: 101-250

Key People: Alex Twigg, Chris Bayliss, David Hornery, Joseph Healy, Kate Keenan, Tim Alexander

Similar companies: Onfido, Jumio

Marketplacer

As a come-of-age SaaS platform, Marketplacer offers a range of tools and functionalities to help create expandable online marketplaces.

Marketplacer has an impressive track record, having played a crucial role in the development and implementation of more than 100 Marketplaces, and successfully connecting over 16,000 businesses globally.

The company at a glance

HQ: Melbourne

Year founded: 2007

Key people: Jason Wyatt, Sam Salter

Number of employees: 101-250

Similar companies: Yo! Kart, Yelo, Logicbroker

Mr Yum

With an innovative menu ordering system, Mr Yum offers versatile options for ordering to meet the preferences of customers. Whether dining at the table, relaxing on the couch or planning a takeaway, food ordering has never looked so innovative.

Mr. Yum’s platform is totally web-based which means you will never have to download an app. Simply scan a QR code, and voila! You have the Mr Yum menu right on your screen.

Further, the menu has filters like vegan, vegetarian, and gluten-free options. It also offers translation into five different languages, detailed ingredient definitions, and eye-catching photos of each dish.

The company at a glance:

HQ: Collingwood

Year founded: 2018

Key People: Adrian Osman, Andrei Miulescu, Kimberly Teo

Number of employees: 11-50

Similar companies: Onfleet, Open Tables

Relectrify

As a 2015 startup, Relectrify is headquartered in Melbourne and specializes in enhancing batteries and optimizing their performance. Their innovative technology allows for the complete utilization of each cell’s capabilities, resulting in improved efficiency.

Additionally, it also reduces costs by generating AC output without the need for an external reverter.

Relectrify has successfully secured multiple funding rounds, including a significant investment from Energy Innovation Capital, although specific financial details of this latest round remain undisclosed.

The company at a glance:

Year Founded: 2015

HQ: Melbourne, Victoria, Australia

No. of employees: 11-50

Key people: Daniel Crowley, Valentin Muenzel

Similar companies: Octave, Cling Systems

Sendle

As a pioneer in carbon-neutral services in the Australian courier industry, Sendle certainly is a one-of-a-kind startup helping small to medium-sized Australian businesses as well as online retailers.

COVID-19 was certainly a boost for Sendle with their business expanding further across the US.

Sendle also successfully secured financing of $35 million in a 2021 Series C funding led by AP Ventures, backed by Afterpay, along with returning investors like Federation, Full Circle, and NRMA.

The company at a glance:

Year founded: 2014

HQ: Sydney

KeyPeople: Craig Davis, James Moody, Kohei NISHIYAMA, Sean Geoghegan

Number of employees: 1-10

Similar companies: Eddress, Xcelerator.

HealthMatch

As a digital healthcare company, HealthMatch aims to revolutionize the process of connecting patients with clinical trials.

The Aussie startup uses advanced machine learning technology to match patients in real time with trials aligned to specific medical profiles. Alongside, the extensive use of artificial intelligence, it helps analyze clinical data and significantly expedite patient recruitment and recovery.

The company at a glance:

Year founded: 2017

HQ: Sydney

Key people: Manuri Gunawardena

Number of employees: 1-10

Similar companies: Six Physio, RichFeel, Cortica

The post 10 Australian Startups In 2023 That Can Change Aussie Lifestyle appeared first on TheAussieway.

]]>The post Why Australian Small Businesses Are Failing In Early Stages appeared first on TheAussieway.

]]>

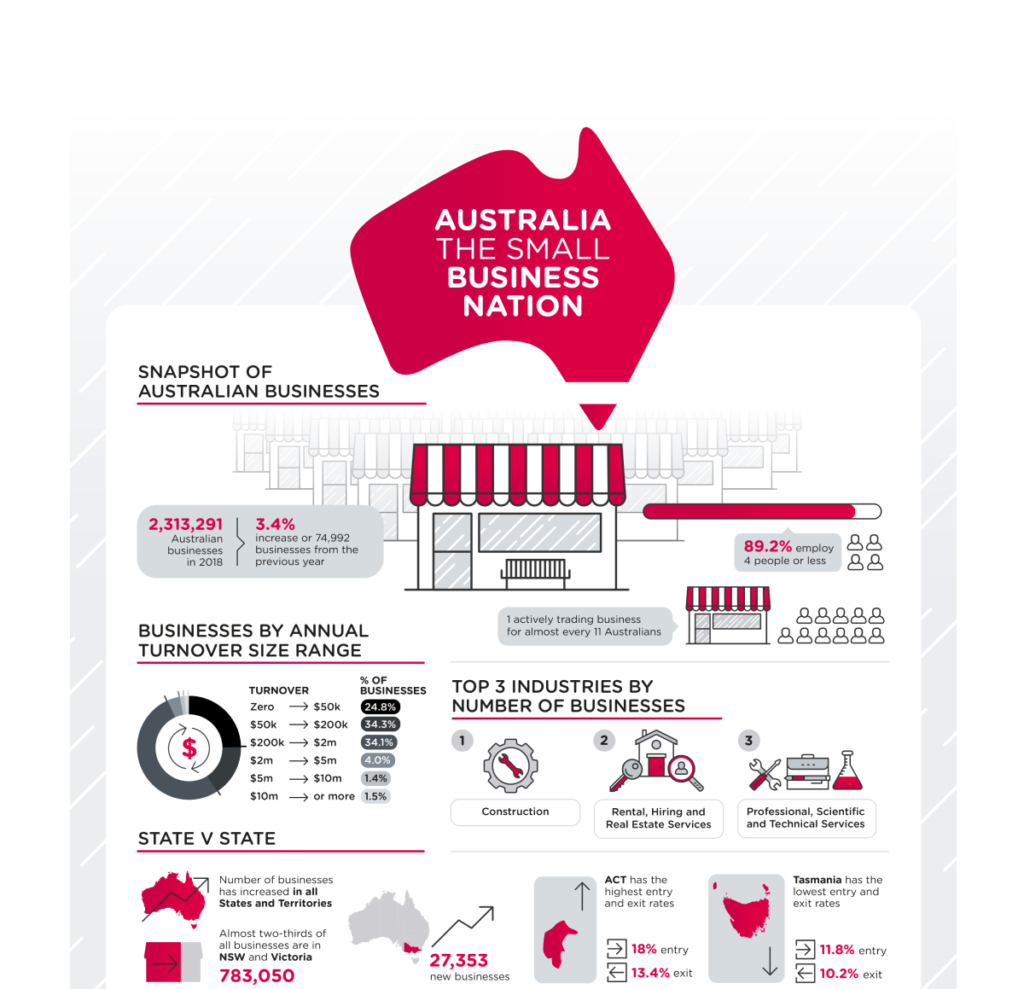

According to estimates, Australia currently has around 2.3 million small businesses. Sadly, one in three newly established small businesses in Australia fail in the first year, followed by two out of four by the end of the second year, and three out of four by the end of the fifth.

A recent study by the University of Technology, Sydney shows that the factors are frequently cited as the cause of business failure are poor financial management, bad management, bad record-keeping, issues with sales and marketing, issues with staffing, failure to seek outside counsel, general economic conditions, and personal factors.

As we dig deeper, we find, Accounting for 32% of all failures, financial mismanagement is the leading reason for business failure. Financial mismanagement refers to several problems, such as a lack of business experience, cash flow problems, starting with insufficient capital, excessive private draws, excessive credit utilisation, a lack of budgeting, and inadequate tax preparation.

Incompetent management is the reason why 15% of businesses fail. 12% of unsuccessful businesses had insufficient or wrong records and some of them don’t even have any case files or books.

11% of businesses fail due to inefficient sales and marketing issues. As Some of the severe problems in this group include a poor promotion, an inability to handle seasonal conditions, and inadequate competitor awareness.

According to another estimate, 9 % of businesses fail due to staffing issues and surprisingly, only 3 % of companies ignore external counsel when facing a crisis. Looking at the bigger perspective, 14% of failures refer to general economic conditions. While, 6 % of businesses fail due to personal reasons like divorce, illness, and changes in circumstances.

However, small businesses in Australia are crucial to the country’s economy since a robust small business sector is necessary for a prosperous economy and also indicates more employment prospects.

So, if you also have a great idea for a small business and have always wanted to be your own boss, then continue reading this article to learn about the mistakes to avoid in running a successful small business.

Some Interesting Facts About Australia Small Businesses

- A company that employs fewer than 20 people is considered a small business. They make up nearly 98% of all businesses.

- Australia’s small Business sector has been the fastest-growing sector, that aged between 45 and 59, 61% of small business owners.

- Australia’s gross domestic product is composed of 35% of small businesses (GDP).

- 44% of the workforce in Australia is employed by small businesses.

- The main industries employing people are farming, forestry, and fishing.

- The second-highest number of workers are employed by small rental, hiring, and real estate businesses.

- There are more apprentices and trainees than in any other industry, with construction ranking third in terms of employment.

Here are some typical reasons why small businesses in Australia tend to fail

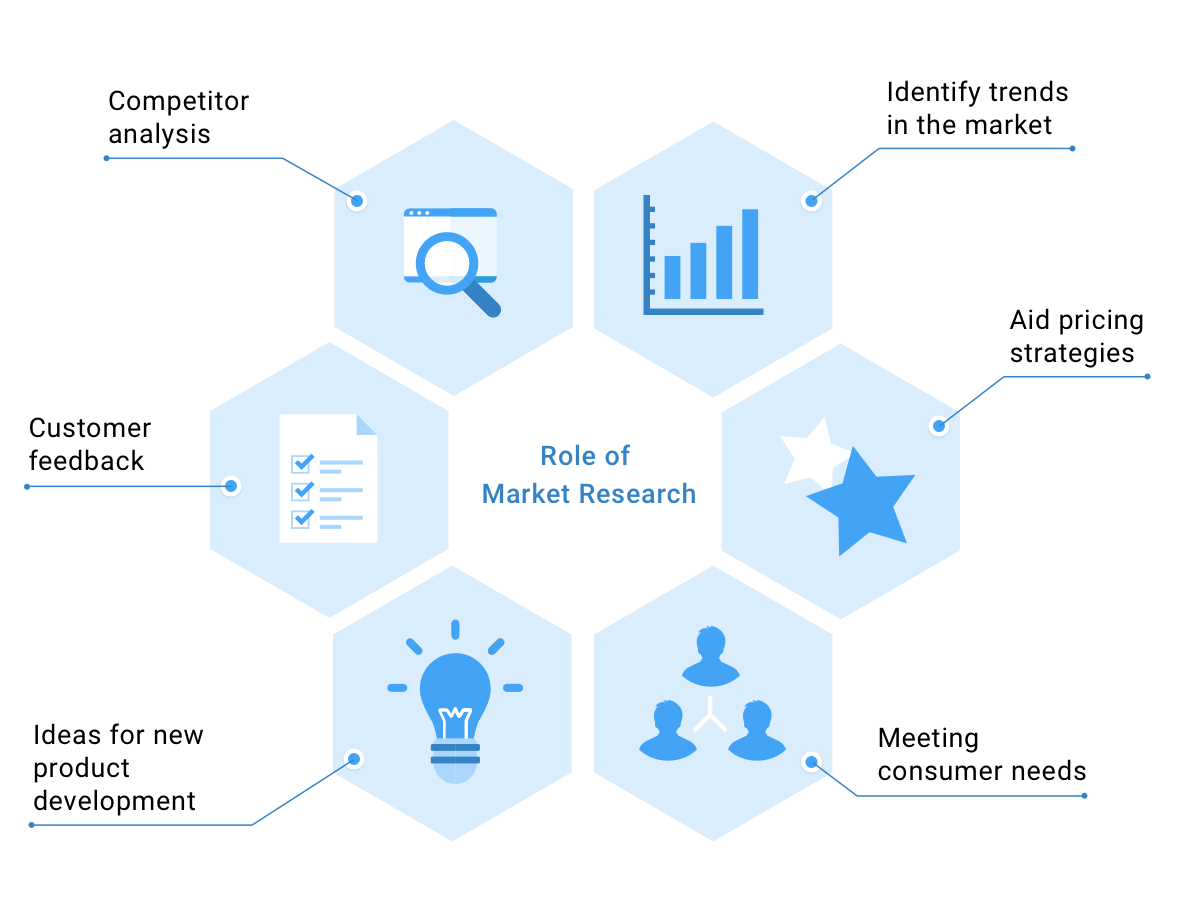

Insufficient Research

One of the most common reasons for new businesses failing is that there is no demand in the market for their goods or services. Knowing who your competitors are, who your target audience is, and what will motivate them to do business with you are some of the most important first steps you need to take when you are setting up a business. Other important first steps include researching everything about the current market and the current and future trends in your industry.

Not Having a Proper Business Plan

A strong business plan may help you decide the direction of your business, an action plan to help you achieve your goals, and get the capital you need to start or grow your business. However, failing to have a plan exposes your organisation to mismanagement, which is one of the most common reasons for small business failure. A business plan can also help you stay organised and on task.

Lacking the Necessary Business Financing

Many small business entrepreneurs fall into the trap of running out of money or not realising the costs associated with starting and maintaining a business. The truth is that not every owner of a small business has the resources to pay the startup fees of a new venture. Therefore, you should incorporate the fixed and variable expenditures associated with starting your business while creating your business plan.

Remember that money is king at all times. It is crucial to bargaining in all areas of your organisation because cash flow problems can cause even profitable companies to fail. Avoid making customers wait too long to pay for your goods and services, and always work to negotiate payment terms with your suppliers that meet the expectations and requirements of your business in terms of cash flow.

Poor Marketing

You have a serious issue on your hands if all of your capital is going towards product development and none is left over for marketing.

A good marketing strategy will strike the right balance between acquiring new customers (new customer acquisition), and cultivating a base of devoted existing customers, depending on the nature of your business and who your target audience is (retention).

Achieving the balance between “conventional” offline marketing operations (including advertising, direct mail, letterbox drops, local area marketing, posters and flyers, and business-to-business marketing) and online marketing (including having a website for your business and using social media for business pages to target your audience) can be challenging sometimes. If marketing isn’t your expertise, engage an experienced marketer or hire a marketing firm. However, whatever you decide, be sure it has a track record of success in your sector.

Failing to Keep Up with New Market Demands or Trends

Building a loyal customer base requires an understanding of your target audience and knowing how to relate with them. To make sure that you stay on top of your client’s needs, you must also have strategies in place. You run the danger of losing those loyal customers to your competitors if you don’t understand what they want from you (via customer feedback surveys, watching and responding to comments on your social media business pages, and just plain talking to your customers).

Speaking of rivals, if they are outperforming you and you run the risk of losing out on sales, you should also keep an eye on what they are doing to keep up with the new trends. So, don’t forget to check out these Australian small business trends in 2022.

Limited Experience

Without a doubt, this is among the most common reasons for a small business to fail in its first year of operation. Lack of planning and poor business analysis reduces the chances of success for inexperienced business owners. If your business doesn’t have enough funding, the problem will get worse.. Everything will collapse if one of these elements breaks down.

Poor Location

This is just another death sentence for small businesses that depend majorly on foot traffic. As a result, small firms that are not located in metropolitan cores or other regions with heavy traffic or densities of people are more likely to declare bankruptcy than those that are more well-known to the general public.

Poor Financial Management

33% of business failures in 2020 were attributed to inadequate financial control, according to reports from external administrators. Financial troubles arise quickly from improper small business finance management and bad credit arrangements, particularly when sales are lower than expected.

Inability to Adapt

Like in life, things don’t always go according to plan in small businesses. It’s inevitable that your business will encounter obstacles along the way, whether it’s responding to shifting trends within your industry, unforeseen occurrences (like the COVID-19 pandemic or natural disasters), the impact of broader economic issues (such as changes to interest rates, government assistance and support), or even changes to your personal situation (due to illness or other challenges). To survive, you might need to change course from a bad hire, an unwise business decision, or an incorrect product or service. The most crucial thing in this situation is to keep aware of what is occurring both inside and outside of your company and to be prepared to react – quickly!

Failing to Recruit and Keep the Correct Personnel

Hiring, managing, and keeping employees is one of the main difficulties small business owners confront. In the long term, it will be beneficial for you to build a varied workforce with complementary skill sets, the proper attitude, and values that are in line with your company. It’s crucial to not only find the proper candidates but also foster an environment at work that encourages long-term employment.

How Many Small Businesses in Australia Are Successful?

You may have heard different reports about how many businesses fail in Australia. Some websites claim that 97% of small businesses in Australia fail. Others claim that the success rates far outweigh the failure rates. Given this, how can you know the truth if you’re thinking about starting your own business?

You now have a better understanding of the facts thanks to the information we gathered from government sources about the success rates of Australian small businesses.

According to the Australian Small Business and Family business Ombudsman’s July 2019 report, a business’ survival percentage increases with size. The success percentage of 0–19 employee small businesses is 59.7%. Businesses with between 20 and 199 employees succeed at a rate of 75.8%.

This is consistent with a previous Australian Bureau of Statistics analysis that found that from 2010 to 2014, the survival percentage for small businesses with no employees was 56%. The percentage rose to 68% for companies with 1-4 employees.

Small businesses in Australia are still less successful than larger corporations on a percentage basis. These figures, however, are not so horrifying that they should utterly discourage businesspeople who want to pursue their aspirations. Having your own small business may, after all, be incredibly satisfying and indeed this is the time to prepare for small business.

The post Why Australian Small Businesses Are Failing In Early Stages appeared first on TheAussieway.

]]>The post Top Australian Start-Ups For Stock Traders To Watch appeared first on TheAussieway.

]]>

Australia is a nation that is highly regarded around the world for its breathtaking natural scenery and its relaxed atmosphere. However, the nation is less well known for having a vibrant and expanding startup environment that produces a large number of successful firms.

The Australian economy is anticipated to expand by 3.4% in 2022. Due to households using their savings to increase consumption, Australia’s economy expanded quicker than anyone had anticipated, because of Australia’s ability to control After the coronavirus outbreaks, which increased consumer and business confidence, the Australian nation has recovered quickly. The talent, investment, and development in the Australian startup sector have been astounding. Heavy corporate support, entrepreneurial founders, a risk-taking mentality, and a strong emphasis on technology and innovation are the startup sector’s main competitive advantages. The cities, like Sydney and Melbourne, have become promising hubs for technology innovation.

With an enormous increase in firms valued at $100 million or more, as well as a nearly twofold increase in later-stage fundraising rounds since 2015, Australia has taken concerted efforts in recent years to support its startup ecosystem. Due to the $4 billion in new funds that Australian venture capital firms raised over the past five years, it has been a fortunate time for venture capital growth.

According to Statistica data, 345,520 new businesses have opened in Australia over the past year, with firms in artificial intelligence (AI) dominating the startup environment.

With the online collaboration platform Atlassian currently making $200 million a year at a $3 billion value, the area is already producing some significant triumphs. Then there is the email marketing firm Campaign Monitor, which we have been following for a while. In April, it raised a whopping $250 million in its initial fundraising round.

About $300 million in funding for Australian internet startups has been monitored during the past year. Here, we’ve selected 10 tech businesses from the area that may catch the attention of Australian stock traders. These companies are ready to disrupt everything from energy to fashion.

RealAR

Year Founded: 2019

HQ: Gold Coast, Queensland, Australia

Size: 1-10

Founders: Dan Swan, Keith Ahern

The owners of both commercial and residential properties may now more easily understand floor layouts, according to Colliers International, a global provider of real estate services that have co-invested in speeding up Australian start-up RealAR to produce affordable visualization tools on a global scale and improve purchasers’ comprehension of precisely what they are contracting.

RealAR is an Australian 3D technology start-up that works with augmented reality software. The software is designed for use in real estate and allows sellers and buyers to envision a property before it is built. 3D plans can be viewed through their app, so customers can understand the layout of the physical spaces.

Residential owners can also picture how outside vistas and streetscapes will affect their new house or modifications, which may give them the extra confidence they need to make a purchase.

RealAR doesn’t need expensive equipment and can quickly turn flat floor plans or models made in standard 3D formats into virtual experiences that can be seen on mobile devices.

They were founded in 2019 and with one seed funding round, the company raised $120,000. RealAR has two investors funding the start-up Dan Swan and Keith Ahern.

Splashup

Year Founded: 2021

HQ: Sydney, New South Wales, Australia

Size: 1-10

Founders: Nathalie Rafeh, Vivek Bharadwaj

Splashup, an AI-powered digital shopping platform, has just received $150,000 in investment as the Xccelerate21 program’s winner. Through x15, a partnership between the Commonwealth Bank of Australia (CBA) and Xccelerate21, experienced business owners and founders of early-stage startups are supported.

Data and tales both have an impact on investors’ decision-making. And Bhardwaj and Rafeh contributed it. The team finished in the top five to present their case for the 150,000 dollars following a frantic and tough fight among 80 entrepreneurs, some of whom are well-known figures.

Vivek Bharadwaj, who is also the co-founder of Splashup, is ecstatic. According to him, hard times were also the birthplace of businesses like Spotify, Airbnb, and others ones. He senses the responsibility’s weight at the same moment. We need to produce results because everyone is watching.

Splashup received $310K Australian over one funding round and they have two investors. The start-up was founded by Nathalie Rafeh and Vivek Bharadwaj in 2021. The company has 1-10 employees and has its headquarters in Sydney Australia.

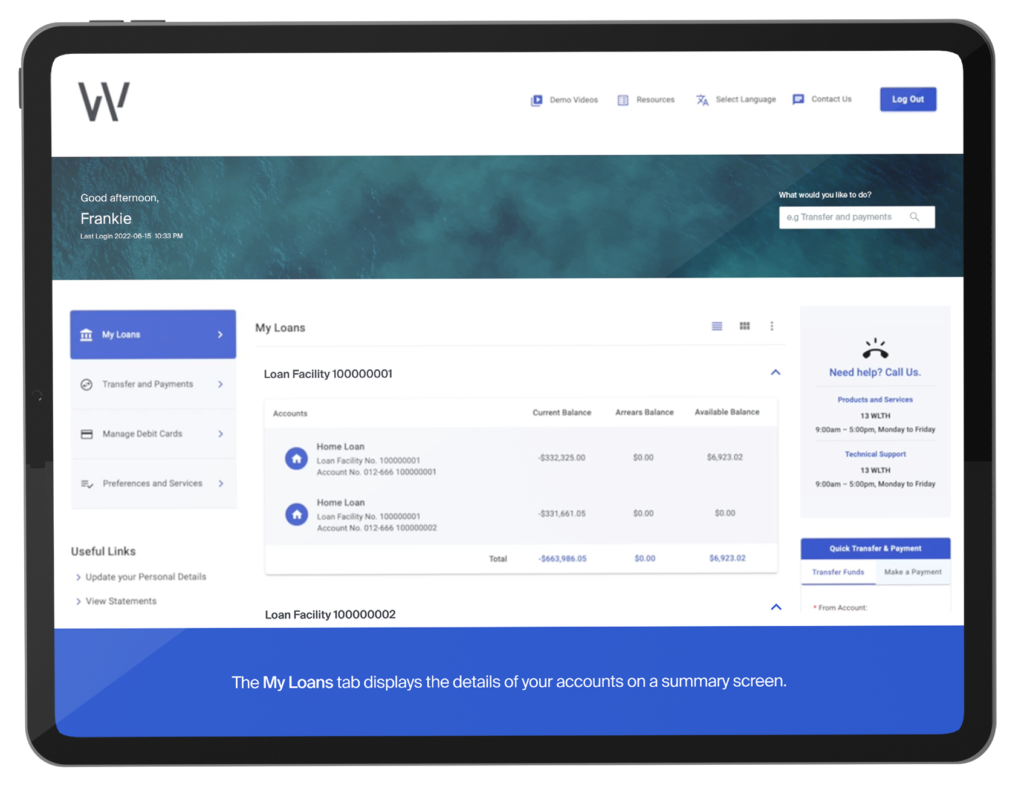

WLTH

Year Founded: 2020

HQ: Brisbane, Australia

Size: 11-50

Founders: Brodie Haupt, Drew Haupt

Their service is based on an entirely online application process called the “Lending Loop” that allows anyone to apply for a house loan in just five simple steps and less than 15 minutes. The company provides a digital financial platform that makes it easier for customers to get access to personal finance and the company also provides an array of solutions for businesses that includes lending, merchant facilities and more.

Since we all are aware of how taxing a mortgage may be, WLTH’s main goal is to offer customers low rates and excellent service. Faster approval times are WLTH’s goal, along with hassle-free and speedy application processes. For every loan that is paid off, WLTH and Parley for the Oceans work together to clean up 50m2 of the Australian ocean and coastline.

WLTH is an Australian startup that was founded in 2020 and is currently headquartered in Brisbane, Australia. Since the business was founded, it has seen good success in attracting outside investment for growth and development. Across two rounds of funding, the business has managed to raise a total of $17.2 million to get business to the next level.

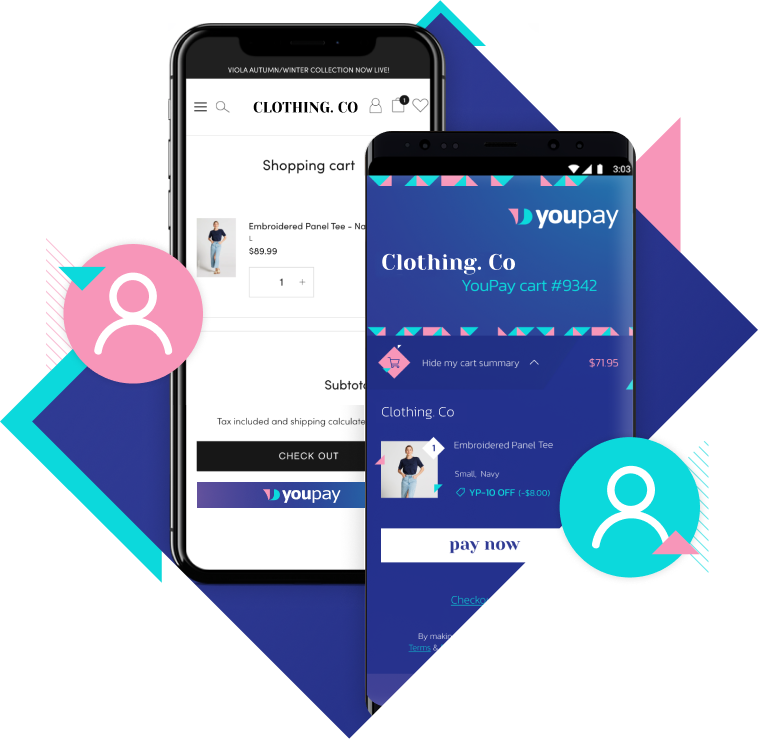

YouPay

Year Founded: 2020

HQ: Springwood, Australia

Size: 11-50

Founders: Matt Holme

Global retail e-commerce sales in 2020 amounted to US$4.28 trillion, and in 2022, it is expected that these sales will increase to US$5.4 trillion. Nevertheless, 88% of carts are left unattended, resulting in US$39 trillion in lost revenue annually.

To alleviate this waste and lessen the amount of unwrapped Christmas presents, YouPay, a Brisbane-based fintech business, has developed a novel solution that isolates the paid from the recipient at the checkout.

Recently launched on online street fashion behemoth and eCommerce success story Culture Kings, the company’s ground-breaking eCommerce solution enables online shoppers to fill their carts and instantly send them to someone else to make purchases on their behalf. In the coming months, the solution is expected to be integrated into the eCommerce platforms of about 250 other brands that have registered their intent to offer it.

YouPay’s cooperative approach to online shopping provides a solution to a dilemma that many consumers face every day: how can you swiftly buy the goods you need or want when someone else is responsible for their payment?

For consumers, YouPay’s solution eliminates inefficiencies in the shopping process for a variety of use cases, including purchases from parents, partners, friends, professionals, employers, charities, and more. It also enhances conversions for eCommerce platforms. You can make these purchases using any of the payment options the business typically provides to its customers.

According to research from The Australia Institute, 30% of Australians anticipate receiving a Christmas gift they won’t use, which results in an annual waste of $980 million in gifts that are typically thrown in the trash.

YouPay is a startup in Australia that was founded in 2020 and is currently located in Springwood, Australia. The company provides a solution for collaborative shopping. Users can shop on the Internet and then send their cart to another person so that they can pay. This is perfect for making it easier to share the cost of shopping and getting gifts.

It has already attracted a good amount of outside investment. For example, the company has gone through two rounds of funding as it stands, with the most recent round being worth $2.9 million.

Loam Bio

Year Founded: 2019

HQ: Orange, New South Wales, Australia

Size: 11-50

Founders: Guy Hudson

Another Australian startup to keep an eye on is Loam Bio. The company creates technology to address the climate crisis while working in the biotechnology sector. Their technology focuses on inoculating crops using symbiotic bacteria. Their cutting-edge microbiology research will increase agricultural productivity while lowering carbon emissions. The power of bacteria is being studied by Loam Bio, which is also creating technologies to make it easier to use them to create food and life-saving medications.

A company that creates microbial carbon sequestration technology with the goal of replenishing soil carbon. The company’s technology enables farmers to improve the host plant’s fertility and resistance to disease as well as help the soil around the plant’s roots store carbon more effectively, resulting in better quality soil for future planting. Symbiotic microorganisms that live in a mutualistic relationship with crops and build organic carbon in the soil can be inoculated into crops using this technology.

Some of the top climate-tech investors in the world have invested $40 million in a soil biology firm with headquarters in Orange, New South Wales.

The business has demonstrated its technique on a modest scale, and they are now prepared to use the funds at a commercial scale to demonstrate that its methodology for improving soil’s potential to sequester carbon may significantly affect global carbon drawdown.

Guy Hudson founded Loam Bio in 2019 and has managed to raise $50 million in funding. This was raised in two funding rounds, the first in 2020 and the second in 2021. The company’s headquarters are in Orange, New South Wales, Australia and they have 11-50 employees.

6clicks

Year Founded: 2019

HQ: Melbourne, Victoria, Australia

Size: 11-50

Founders: Andrew Robinson, Anthony Stevens, Louis Strauss

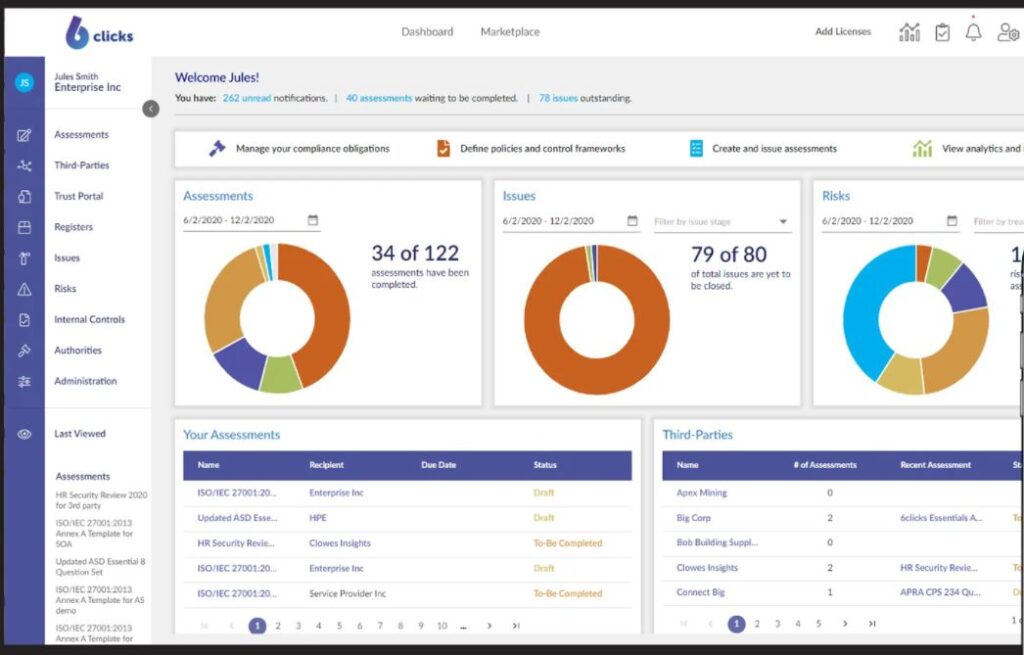

To automate and manage risk assessment, risk management, and compliance, there is a cloud-based platform called 6clicks. You may design, send, and receive assessments using the 6clicks platform to guarantee continuing compliance both inside and outside of your organisation.

The 6clicks proposition is in high demand, which is advancing the situation. The company’s configurable solutions come with pre-existing regulatory frameworks, templates, and libraries for risk assessment, as well as an app to monitor risk and a news site (called 6clicks Pulse) for the most recent regulatory developments.

A dynamic and unstable global regulatory framework, supported by regtech and compliance technology, serves as fuel for this claim. According to Stevens, the global market is currently worth about US$31 billion and is projected to grow to US$88 billion by 2027. And even before the pandemic, this was already trending upward.

In addition to the $2.2 million raised in July of last year, 6clicks has now raised $5 million in a fresh investment round. With the additional funding, the RegTech startup—founded by former KPMG advisors—plans to embark on a global expansion drive.

Melbourne-based, A cloud-based technology firm called 6clicks is designed to automate every step of the risk management process, from assessment to compliance. In conjunction with former KPMG digital consultant Louis Strauss, former partner and chief digital officer Anthony Stevens, and TrustyGate founder Andrew Robinson, the company was created in 2019.

The company’s headquarters are in Melbourne, Victoria, Australia and is made up of around 11 to 50 employees. The founders are Andrew Robinson, Anthony Stevens, and Louis Strauss and they founded the organisation in 2019. Since then, they have managed to gain $8 million Australian in funding, in four funding rounds.

Vacaay

Year Founded: 2019

HQ: Sydney, New South Wales, Australia

Size: 11-50

Founders: Pete McKeon

Despite the industry’s uncertainties during the pandemic, consumers have flocked to Vacaay’s entertaining and cutting-edge travel discovery platform to start planning their vacations well in advance. The company added an astounding 100,000 new members in its first 30 days.

The first of its type in the travel industry, Vacaay delivers curated travel content unlike ever before with a user-friendly mobile app and responsive travel media platform. Travellers can easily explore thousands of breathtaking locations around the globe with a swipe of their smartphone thanks to Vacaay, which enables them to find incredible locations they might not have otherwise thought to visit.

The innovative new platform is proving to be incredibly popular, especially among its target demographic of tech-savvy travellers between the ages of 25 and 45, with users exploring more than 75,000 locations in a single day.

Vacaay is a technology platform that works in the travel industry. The business provides organisations with the ability to enlarge their reach, gaining new audiences and customers. It does this by collecting data about consumer travel behaviours. Holidayers can visit the Vacaay website and create an itinerary which then helps tourism boards prepare and refine their marketing strategy. The website is made up of promotional content for different places in the world, to inspire the consumer on where to travel.

Vacay was founded in 2019 by Pete McKeon. It has its headquarters in Sydney, New South Wales, Australia and has around 11 to 50 employees. The tech company has raised $250,000 from one funding round in October 2019.

MGA Thermal

Year Founded: 2019

HQ: Newcastle, New South Wales, Australia

Size: 1-10

Founders: Alexander Post, Dylan Cuskelly, Erich Kisi

MGA Thermal is an Australian tech start-up in the thermal storage industry. MGA stands for Miscibility Gap Alloys and these are the basis for the company. MGA Thermal provides customers with an economical and efficient way of storing energy and heating. The miscibility gap alloys are what store the energy and are stacked into storage tanks. It is a renewable alternative for energy storage and is scalable.

The Australian Renewable Energy Agency (ARENA) has awarded MGA Thermal, an Australian sustainable energy firm, AUS$1.27 million (USD$900,000) to expand its thermal energy storage technology.

The grant will contribute to the installation of a 5MWh medium duration thermal energy storage pilot to show off charging and discharging capacities of up to 500kW while also generating steam from the thermal energy stored.

Specifically created (MGA) blocks from the company capture and store thermal energy from either renewable electricity or industrial waste heat.

With little energy loss, the MGA blocks can hold heat for times of hours to days. A transfer gas is used in heat exchangers to absorb heat from MGA blocks, and the heated gas or fluid can be used for industrial heating purposes or to power a steam turbine to produce electricity.

Using this energy, direct heat is produced for use in industrial settings or steam is produced to power turbines.

According to MGA Thermal, this approach can be utilised to convert thermal storage-equipped coal-fired power stations into cleaner baseload power sources, preventing the closure of these facilities in the process.

The founders of MGA Thermal are Alexander Post, Dylan Cuskelly, Erich Kisi. Its headquarters are in Newcastle, New South Wales, Australia and there are 1 to 10 employees. Since it was founded in 2019, the business has raised $6.3 million in three funding rounds.

The post Top Australian Start-Ups For Stock Traders To Watch appeared first on TheAussieway.

]]>