The post Top Australian Start-Ups For Stock Traders To Watch appeared first on TheAussieway.

]]>

Australia is a nation that is highly regarded around the world for its breathtaking natural scenery and its relaxed atmosphere. However, the nation is less well known for having a vibrant and expanding startup environment that produces a large number of successful firms.

The Australian economy is anticipated to expand by 3.4% in 2022. Due to households using their savings to increase consumption, Australia’s economy expanded quicker than anyone had anticipated, because of Australia’s ability to control After the coronavirus outbreaks, which increased consumer and business confidence, the Australian nation has recovered quickly. The talent, investment, and development in the Australian startup sector have been astounding. Heavy corporate support, entrepreneurial founders, a risk-taking mentality, and a strong emphasis on technology and innovation are the startup sector’s main competitive advantages. The cities, like Sydney and Melbourne, have become promising hubs for technology innovation.

With an enormous increase in firms valued at $100 million or more, as well as a nearly twofold increase in later-stage fundraising rounds since 2015, Australia has taken concerted efforts in recent years to support its startup ecosystem. Due to the $4 billion in new funds that Australian venture capital firms raised over the past five years, it has been a fortunate time for venture capital growth.

According to Statistica data, 345,520 new businesses have opened in Australia over the past year, with firms in artificial intelligence (AI) dominating the startup environment.

With the online collaboration platform Atlassian currently making $200 million a year at a $3 billion value, the area is already producing some significant triumphs. Then there is the email marketing firm Campaign Monitor, which we have been following for a while. In April, it raised a whopping $250 million in its initial fundraising round.

About $300 million in funding for Australian internet startups has been monitored during the past year. Here, we’ve selected 10 tech businesses from the area that may catch the attention of Australian stock traders. These companies are ready to disrupt everything from energy to fashion.

RealAR

Year Founded: 2019

HQ: Gold Coast, Queensland, Australia

Size: 1-10

Founders: Dan Swan, Keith Ahern

The owners of both commercial and residential properties may now more easily understand floor layouts, according to Colliers International, a global provider of real estate services that have co-invested in speeding up Australian start-up RealAR to produce affordable visualization tools on a global scale and improve purchasers’ comprehension of precisely what they are contracting.

RealAR is an Australian 3D technology start-up that works with augmented reality software. The software is designed for use in real estate and allows sellers and buyers to envision a property before it is built. 3D plans can be viewed through their app, so customers can understand the layout of the physical spaces.

Residential owners can also picture how outside vistas and streetscapes will affect their new house or modifications, which may give them the extra confidence they need to make a purchase.

RealAR doesn’t need expensive equipment and can quickly turn flat floor plans or models made in standard 3D formats into virtual experiences that can be seen on mobile devices.

They were founded in 2019 and with one seed funding round, the company raised $120,000. RealAR has two investors funding the start-up Dan Swan and Keith Ahern.

Splashup

Year Founded: 2021

HQ: Sydney, New South Wales, Australia

Size: 1-10

Founders: Nathalie Rafeh, Vivek Bharadwaj

Splashup, an AI-powered digital shopping platform, has just received $150,000 in investment as the Xccelerate21 program’s winner. Through x15, a partnership between the Commonwealth Bank of Australia (CBA) and Xccelerate21, experienced business owners and founders of early-stage startups are supported.

Data and tales both have an impact on investors’ decision-making. And Bhardwaj and Rafeh contributed it. The team finished in the top five to present their case for the 150,000 dollars following a frantic and tough fight among 80 entrepreneurs, some of whom are well-known figures.

Vivek Bharadwaj, who is also the co-founder of Splashup, is ecstatic. According to him, hard times were also the birthplace of businesses like Spotify, Airbnb, and others ones. He senses the responsibility’s weight at the same moment. We need to produce results because everyone is watching.

Splashup received $310K Australian over one funding round and they have two investors. The start-up was founded by Nathalie Rafeh and Vivek Bharadwaj in 2021. The company has 1-10 employees and has its headquarters in Sydney Australia.

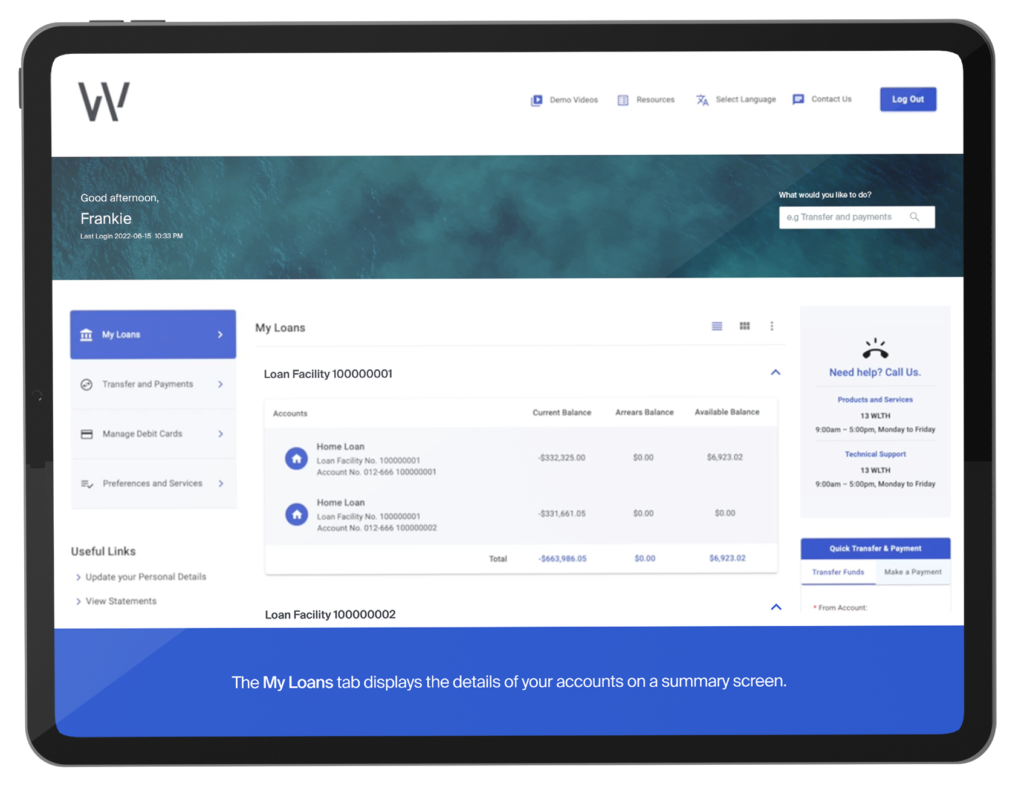

WLTH

Year Founded: 2020

HQ: Brisbane, Australia

Size: 11-50

Founders: Brodie Haupt, Drew Haupt

Their service is based on an entirely online application process called the “Lending Loop” that allows anyone to apply for a house loan in just five simple steps and less than 15 minutes. The company provides a digital financial platform that makes it easier for customers to get access to personal finance and the company also provides an array of solutions for businesses that includes lending, merchant facilities and more.

Since we all are aware of how taxing a mortgage may be, WLTH’s main goal is to offer customers low rates and excellent service. Faster approval times are WLTH’s goal, along with hassle-free and speedy application processes. For every loan that is paid off, WLTH and Parley for the Oceans work together to clean up 50m2 of the Australian ocean and coastline.

WLTH is an Australian startup that was founded in 2020 and is currently headquartered in Brisbane, Australia. Since the business was founded, it has seen good success in attracting outside investment for growth and development. Across two rounds of funding, the business has managed to raise a total of $17.2 million to get business to the next level.

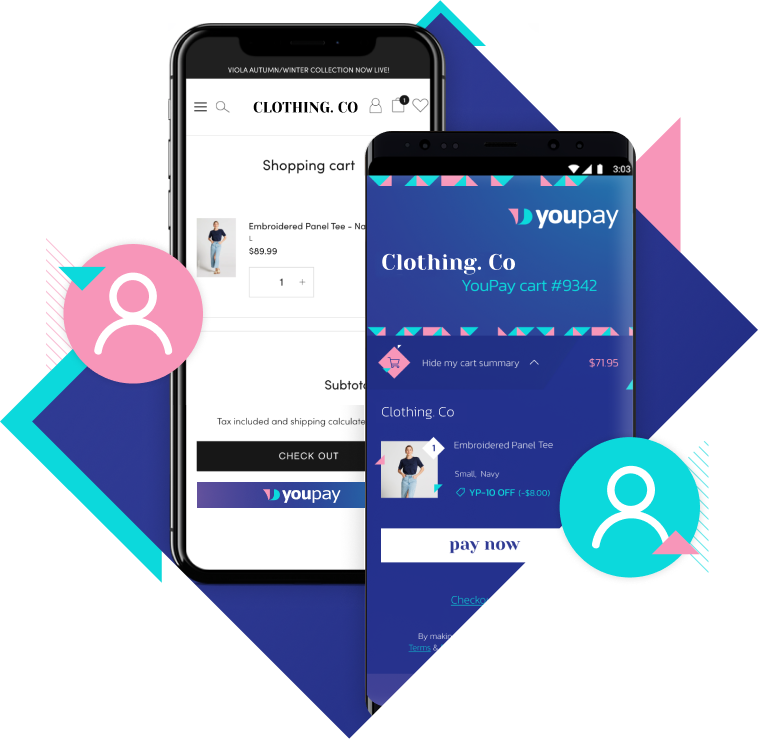

YouPay

Year Founded: 2020

HQ: Springwood, Australia

Size: 11-50

Founders: Matt Holme

Global retail e-commerce sales in 2020 amounted to US$4.28 trillion, and in 2022, it is expected that these sales will increase to US$5.4 trillion. Nevertheless, 88% of carts are left unattended, resulting in US$39 trillion in lost revenue annually.

To alleviate this waste and lessen the amount of unwrapped Christmas presents, YouPay, a Brisbane-based fintech business, has developed a novel solution that isolates the paid from the recipient at the checkout.

Recently launched on online street fashion behemoth and eCommerce success story Culture Kings, the company’s ground-breaking eCommerce solution enables online shoppers to fill their carts and instantly send them to someone else to make purchases on their behalf. In the coming months, the solution is expected to be integrated into the eCommerce platforms of about 250 other brands that have registered their intent to offer it.

YouPay’s cooperative approach to online shopping provides a solution to a dilemma that many consumers face every day: how can you swiftly buy the goods you need or want when someone else is responsible for their payment?

For consumers, YouPay’s solution eliminates inefficiencies in the shopping process for a variety of use cases, including purchases from parents, partners, friends, professionals, employers, charities, and more. It also enhances conversions for eCommerce platforms. You can make these purchases using any of the payment options the business typically provides to its customers.

According to research from The Australia Institute, 30% of Australians anticipate receiving a Christmas gift they won’t use, which results in an annual waste of $980 million in gifts that are typically thrown in the trash.

YouPay is a startup in Australia that was founded in 2020 and is currently located in Springwood, Australia. The company provides a solution for collaborative shopping. Users can shop on the Internet and then send their cart to another person so that they can pay. This is perfect for making it easier to share the cost of shopping and getting gifts.

It has already attracted a good amount of outside investment. For example, the company has gone through two rounds of funding as it stands, with the most recent round being worth $2.9 million.

Loam Bio

Year Founded: 2019

HQ: Orange, New South Wales, Australia

Size: 11-50

Founders: Guy Hudson

Another Australian startup to keep an eye on is Loam Bio. The company creates technology to address the climate crisis while working in the biotechnology sector. Their technology focuses on inoculating crops using symbiotic bacteria. Their cutting-edge microbiology research will increase agricultural productivity while lowering carbon emissions. The power of bacteria is being studied by Loam Bio, which is also creating technologies to make it easier to use them to create food and life-saving medications.

A company that creates microbial carbon sequestration technology with the goal of replenishing soil carbon. The company’s technology enables farmers to improve the host plant’s fertility and resistance to disease as well as help the soil around the plant’s roots store carbon more effectively, resulting in better quality soil for future planting. Symbiotic microorganisms that live in a mutualistic relationship with crops and build organic carbon in the soil can be inoculated into crops using this technology.

Some of the top climate-tech investors in the world have invested $40 million in a soil biology firm with headquarters in Orange, New South Wales.

The business has demonstrated its technique on a modest scale, and they are now prepared to use the funds at a commercial scale to demonstrate that its methodology for improving soil’s potential to sequester carbon may significantly affect global carbon drawdown.

Guy Hudson founded Loam Bio in 2019 and has managed to raise $50 million in funding. This was raised in two funding rounds, the first in 2020 and the second in 2021. The company’s headquarters are in Orange, New South Wales, Australia and they have 11-50 employees.

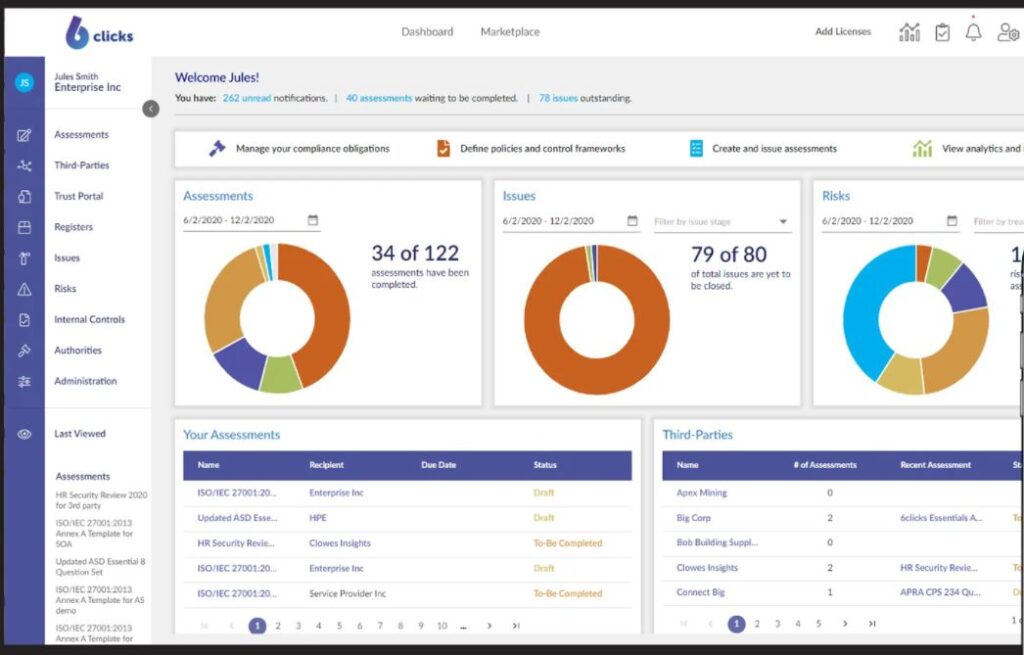

6clicks

Year Founded: 2019

HQ: Melbourne, Victoria, Australia

Size: 11-50

Founders: Andrew Robinson, Anthony Stevens, Louis Strauss

To automate and manage risk assessment, risk management, and compliance, there is a cloud-based platform called 6clicks. You may design, send, and receive assessments using the 6clicks platform to guarantee continuing compliance both inside and outside of your organisation.

The 6clicks proposition is in high demand, which is advancing the situation. The company’s configurable solutions come with pre-existing regulatory frameworks, templates, and libraries for risk assessment, as well as an app to monitor risk and a news site (called 6clicks Pulse) for the most recent regulatory developments.

A dynamic and unstable global regulatory framework, supported by regtech and compliance technology, serves as fuel for this claim. According to Stevens, the global market is currently worth about US$31 billion and is projected to grow to US$88 billion by 2027. And even before the pandemic, this was already trending upward.

In addition to the $2.2 million raised in July of last year, 6clicks has now raised $5 million in a fresh investment round. With the additional funding, the RegTech startup—founded by former KPMG advisors—plans to embark on a global expansion drive.

Melbourne-based, A cloud-based technology firm called 6clicks is designed to automate every step of the risk management process, from assessment to compliance. In conjunction with former KPMG digital consultant Louis Strauss, former partner and chief digital officer Anthony Stevens, and TrustyGate founder Andrew Robinson, the company was created in 2019.

The company’s headquarters are in Melbourne, Victoria, Australia and is made up of around 11 to 50 employees. The founders are Andrew Robinson, Anthony Stevens, and Louis Strauss and they founded the organisation in 2019. Since then, they have managed to gain $8 million Australian in funding, in four funding rounds.

Vacaay

Year Founded: 2019

HQ: Sydney, New South Wales, Australia

Size: 11-50

Founders: Pete McKeon

Despite the industry’s uncertainties during the pandemic, consumers have flocked to Vacaay’s entertaining and cutting-edge travel discovery platform to start planning their vacations well in advance. The company added an astounding 100,000 new members in its first 30 days.

The first of its type in the travel industry, Vacaay delivers curated travel content unlike ever before with a user-friendly mobile app and responsive travel media platform. Travellers can easily explore thousands of breathtaking locations around the globe with a swipe of their smartphone thanks to Vacaay, which enables them to find incredible locations they might not have otherwise thought to visit.

The innovative new platform is proving to be incredibly popular, especially among its target demographic of tech-savvy travellers between the ages of 25 and 45, with users exploring more than 75,000 locations in a single day.

Vacaay is a technology platform that works in the travel industry. The business provides organisations with the ability to enlarge their reach, gaining new audiences and customers. It does this by collecting data about consumer travel behaviours. Holidayers can visit the Vacaay website and create an itinerary which then helps tourism boards prepare and refine their marketing strategy. The website is made up of promotional content for different places in the world, to inspire the consumer on where to travel.

Vacay was founded in 2019 by Pete McKeon. It has its headquarters in Sydney, New South Wales, Australia and has around 11 to 50 employees. The tech company has raised $250,000 from one funding round in October 2019.

MGA Thermal

Year Founded: 2019

HQ: Newcastle, New South Wales, Australia

Size: 1-10

Founders: Alexander Post, Dylan Cuskelly, Erich Kisi

MGA Thermal is an Australian tech start-up in the thermal storage industry. MGA stands for Miscibility Gap Alloys and these are the basis for the company. MGA Thermal provides customers with an economical and efficient way of storing energy and heating. The miscibility gap alloys are what store the energy and are stacked into storage tanks. It is a renewable alternative for energy storage and is scalable.

The Australian Renewable Energy Agency (ARENA) has awarded MGA Thermal, an Australian sustainable energy firm, AUS$1.27 million (USD$900,000) to expand its thermal energy storage technology.

The grant will contribute to the installation of a 5MWh medium duration thermal energy storage pilot to show off charging and discharging capacities of up to 500kW while also generating steam from the thermal energy stored.

Specifically created (MGA) blocks from the company capture and store thermal energy from either renewable electricity or industrial waste heat.

With little energy loss, the MGA blocks can hold heat for times of hours to days. A transfer gas is used in heat exchangers to absorb heat from MGA blocks, and the heated gas or fluid can be used for industrial heating purposes or to power a steam turbine to produce electricity.

Using this energy, direct heat is produced for use in industrial settings or steam is produced to power turbines.

According to MGA Thermal, this approach can be utilised to convert thermal storage-equipped coal-fired power stations into cleaner baseload power sources, preventing the closure of these facilities in the process.

The founders of MGA Thermal are Alexander Post, Dylan Cuskelly, Erich Kisi. Its headquarters are in Newcastle, New South Wales, Australia and there are 1 to 10 employees. Since it was founded in 2019, the business has raised $6.3 million in three funding rounds.

The post Top Australian Start-Ups For Stock Traders To Watch appeared first on TheAussieway.

]]>